According to the Saint Louis Federal Reserve, the United States total public debt as a percentage of gross domestic product increased from 54% in the year 2000 to 122% today. The reasons are well understood and include the 2008 financial crisis, the 2017 Tax Cuts and Jobs Act, and multiple COVID-19 stimulus packages. Last year, the Wharton School at the University of Pennsylvania published a brief calling out the risks facing financial markets without a change in federal fiscal policy.

What are the available options to address the budget deficit?

Reduce expenses (i.e. cut federal spending)

Roughly half the federal budget consists of social security and healthcare (e.g. Medicare, Medicaid, ACA) alongside another 16% of mandatory spending (such as interest payments on the debt) that collectively make up two-thirds of total spending. Both presumptive presidential nominees for the 2024 election have publicly ruled out benefit cuts, making this seem an unlikely option.

Increase revenues (i.e. increase taxes)

Increasing revenues alone to stabilize the national debt would require roughly $2,400 annually per taxpayer. Shifting that burden only to the 2.8M households making more than $400,000 would increase taxes by $283k annually for each household. While it is possible Congress raises taxes by 2.2% of GDP, it seems unlikely in today’s political climate.

Debt monetization (i.e. print money)

The United States is in the unique position of having its national currency also act as the world’s reserve currency. US debt is denominated in dollars and the US alone has the authority to create dollars. This means the government can decide to “borrow” from the central bank and increase the supply of money to pay down the debt. This course of action would decrease the value of the dollar (because there would be more of them) and spark inflation. For an example of what happens when governments print money on a large scale, refer to the histories of Zimbabwe, Weimer Germany, or present-day Venezuela.

Why does this matter for investors?

While we cannot predict the future, we can prepare for it. Certain assets offer better inflation protection than others. At the extreme, cash under a mattress offers no inflation protection.

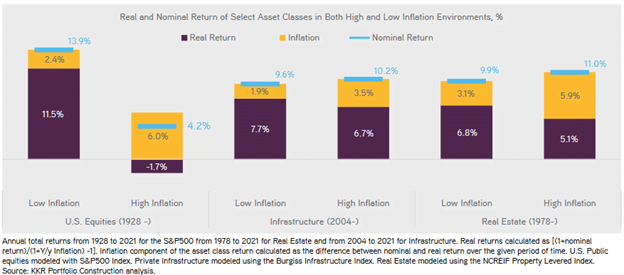

KKR analyzed historical returns by asset class in both high and low inflationary environments.

As you can see, real estate offered the best returns during times of high inflation.

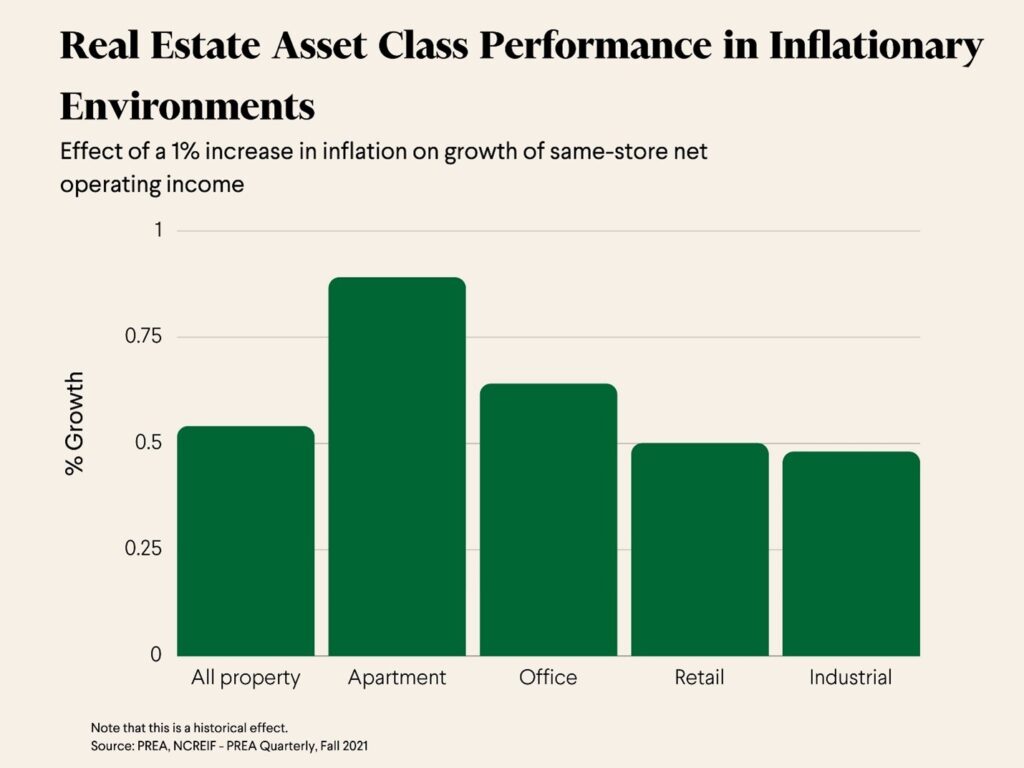

Real estate consists of multiple asset classes and multifamily (apartments) outperformed the others. This is expected due to the short (usually one year) lease terms that allow multifamily operators to increase rents annually alongside inflation. While other property types can have rent increases built into the lease term, they may be capped at an annual maximum.

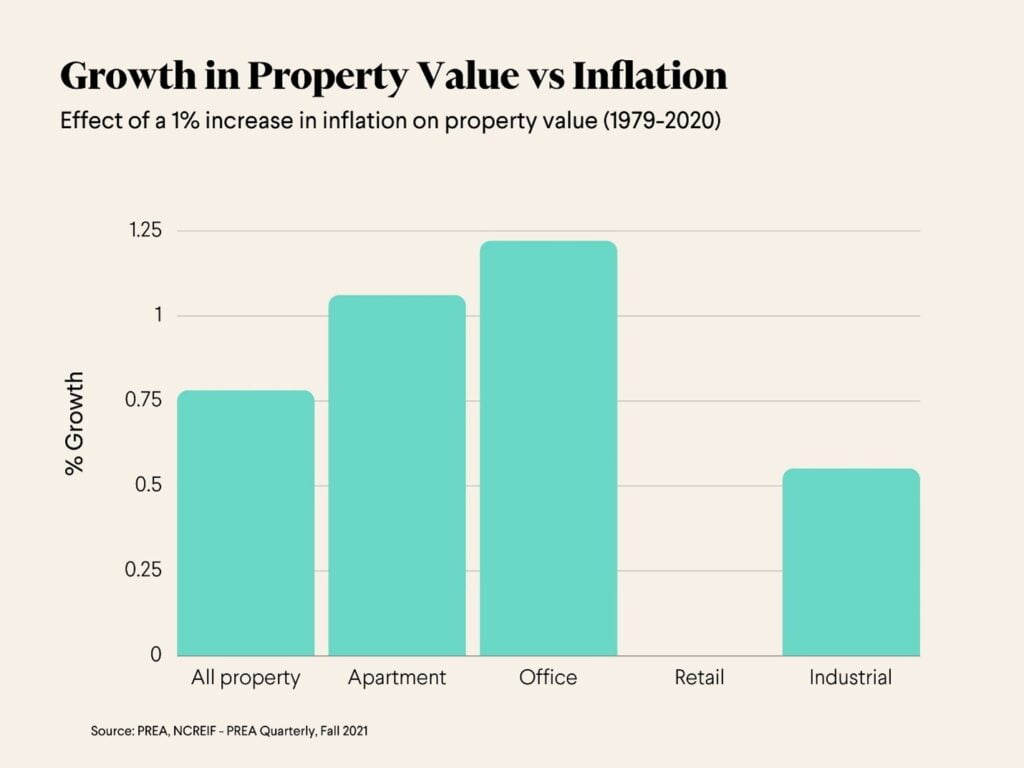

In addition to short leases, multifamily also benefits from being a “hard asset”. As seen in the graph above, apartment property values typically increase in-line (or in-excess) with inflation.

Summary

- Higher inflation is a very real possibility due to ongoing federal budgets deficits

- Real estate has historically outperformed other assets classes in times of high inflation

- Multifamily is especially well-positioned due to short leases and its non-discretionary nature versus other types of real estate

Please contact us if you are interested in adding multifamily to your portfolio as a hedge against inflation.